- Published on

Use Heath-Jarrow-Morton and Nelson-Siegel to construct US Treasury yield curve

- Authors

- Name

- Benton Li

Prerequisite:

- HJM

- Forward rate

- Zero-coupon bond

Intro

In this blog, we will use HJM to project US Treasury yield curves and price US Treasury Futures. Be aware that this blog is solely for educational purposes. Do not use this for trading

Notations of forward rate:

- : forward rate, locked in at time , effective at time , with a tenor of units of time, i.e. borrowing/lending takes place from to

- : instant forward rate at time , locked-in at time

- : spot rate for borrowing/lending over [ to ]

- : instant spot rate for borrowing/lending over [ to ] where is a small time horizon (e.g. overnight)

import warnings

import pandas as pd

import numpy as np

np.random.seed(69420)

import matplotlib.pyplot as plt

import matplotlib.dates as mdates

from sklearn.decomposition import PCA

from scipy.optimize import curve_fit

import scipy.integrate as integrate

from scipy.stats import norm

import time

warnings.filterwarnings("ignore")

plt.style.use('dark_background')

US Treasury Par Yields

We will use the US Treasury par yields as a proxy of forward rate.

# Real data

df = pd.read_csv("https://lorry.limacon.me/api/public/v2/us_treasury_par_yield")

df = df.set_index('Date')

df.index = pd.to_datetime(df.index, format='%m/%d/%Y', errors='coerce')

par_yields = df.dropna(axis=1, how='any') # Drop any Treasury that has NaN values

par_yields = par_yields.sort_index(ascending=True) # Index by Date

par_yields /= 100

# The x-axis would be tenors: noted as big Delta

# The y-axis would be past dates: noted as small t

# i.e. par_yields[t][D] is a spot rate r(t,t,D)

tenors_str = np.array(par_yields.columns)

def tenor_str_to_float(tenors_str):

if isinstance(tenors_str, (list,pd.core.series.Series,np.ndarray)):

return np.array(list(map(tenor_str_to_float, tenors_str)))

length, unit = tenors_str.split(' ')

length = float(length)

if unit == 'Mo':

return length / 12

elif unit == 'Yr':

return length

def tenor_float_to_str(tenor_float):

if isinstance(tenor_float, (list,pd.core.series.Series,np.ndarray)):

return np.array(list(map(tenor_float_to_str, tenor_float)))

if float(tenor_float) > 1 :

return f'{tenor_float} Yr'

else:

return f'{tenor_float*12} Mo'

tenors_float = tenor_str_to_float(tenors_str)

dates = list(par_yields.index)

print('Sample yield curves')

display(par_yields.iloc[::90,:])

Sample yield curves

| 1 Mo | 2 Mo | 3 Mo | 6 Mo | 1 Yr | 2 Yr | 3 Yr | 5 Yr | 7 Yr | 10 Yr | 20 Yr | 30 Yr | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||||

| 2022-01-03 | 0.0005 | 0.0006 | 0.0008 | 0.0022 | 0.0040 | 0.0078 | 0.0104 | 0.0137 | 0.0155 | 0.0163 | 0.0205 | 0.0201 |

| 2022-05-12 | 0.0061 | 0.0077 | 0.0096 | 0.0144 | 0.0196 | 0.0256 | 0.0273 | 0.0281 | 0.0286 | 0.0284 | 0.0322 | 0.0300 |

| 2022-09-21 | 0.0259 | 0.0306 | 0.0331 | 0.0386 | 0.0408 | 0.0402 | 0.0398 | 0.0374 | 0.0365 | 0.0351 | 0.0373 | 0.0350 |

| 2023-02-02 | 0.0462 | 0.0465 | 0.0466 | 0.0476 | 0.0464 | 0.0409 | 0.0375 | 0.0349 | 0.0344 | 0.0340 | 0.0367 | 0.0355 |

| 2023-06-12 | 0.0524 | 0.0531 | 0.0540 | 0.0538 | 0.0518 | 0.0455 | 0.0416 | 0.0389 | 0.0382 | 0.0373 | 0.0404 | 0.0387 |

| 2023-10-20 | 0.0556 | 0.0556 | 0.0558 | 0.0554 | 0.0541 | 0.0507 | 0.0493 | 0.0486 | 0.0493 | 0.0493 | 0.0527 | 0.0509 |

| 2024-03-01 | 0.0554 | 0.0549 | 0.0542 | 0.0527 | 0.0494 | 0.0454 | 0.0432 | 0.0417 | 0.0420 | 0.0419 | 0.0446 | 0.0433 |

| 2024-07-11 | 0.0548 | 0.0553 | 0.0544 | 0.0525 | 0.0491 | 0.0450 | 0.0426 | 0.0413 | 0.0415 | 0.0420 | 0.0451 | 0.0441 |

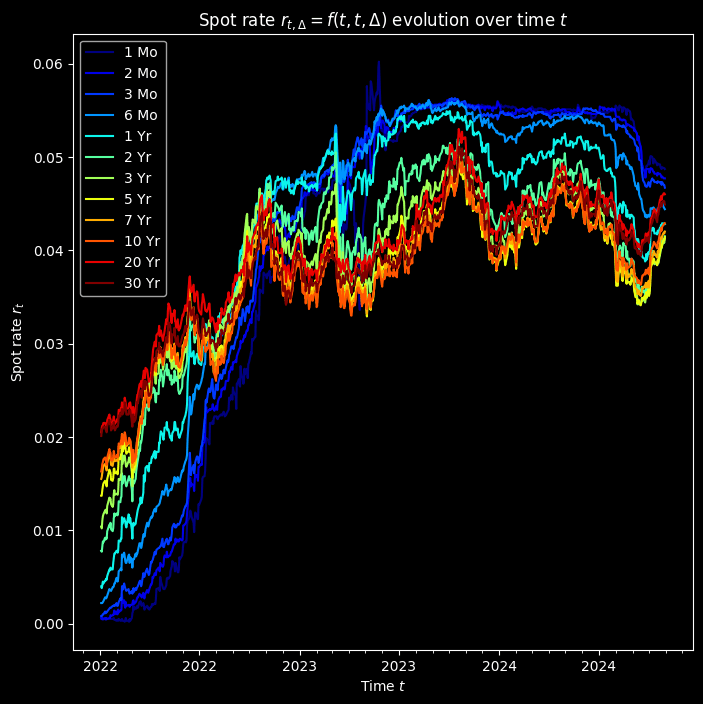

Spot rate vs time

We first plot each tenor's par yield against the time t. There are some interesting patterns, such as rate hikes since 2022, yield inversion in 2022Q3, the rate cut in 2024Q3.

fig, ax = plt.subplots(figsize=(8,8))

ax.set_xlabel(f'Time $t$')

ax.set_ylabel(f'Spot rate $r_t$')

colors = plt.cm.jet(np.linspace(0,1,len(tenors_str)))

ax.xaxis.set_major_locator(mdates.MonthLocator(bymonth=(1, 7)))

ax.xaxis.set_minor_locator(mdates.MonthLocator())

for i, tenor in enumerate(tenors_str):

ax.plot(par_yields.index, par_yields[tenor], label=tenor, color=colors[i])

ax.legend(loc='best')

plt.title('Spot rate $r_{t, \Delta} = f(t,t,\Delta )$ evolution over time $t$')

plt.show();

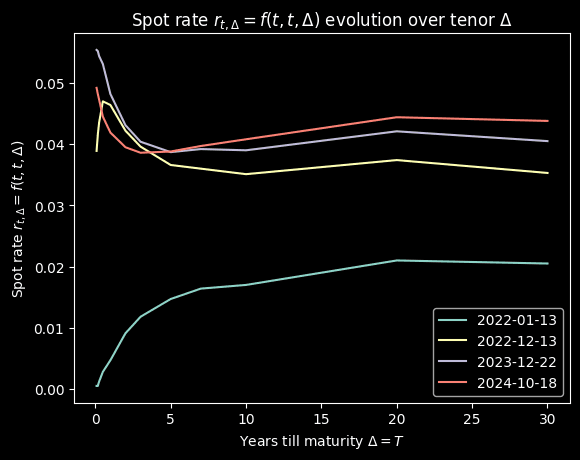

Spot rate vs tenor

Then we plot the yield against for some selected dates

plt.xlabel(f'Years till maturity $\Delta = T$')

plt.ylabel('Spot rate $r_{t, \Delta} = f(t,t,\Delta )$ ')

selected_dates = ['2022-01-13', '2022-12-13', '2023-12-22', '2024-10-18']

colors = plt.cm.jet(np.linspace(0.7,1,len(selected_dates)))

for i, date_ in enumerate(selected_dates):

plt.plot(tenors_float, par_yields.loc[date_], label=date_)

plt.legend(loc='best')

plt.title('Spot rate $r_{t, \Delta} = f(t,t,\Delta )$ evolution over tenor $\Delta$')

plt.show();

Backgound

The US had been in a low interest rate environment since COVID. Then in March 2022, the Fed had been raising effective federal funds rate (EFFR) till July 2023. Then we see the first rate cut since then in July 2024. Over this time the entire curve shifts up. The yield curve inverted in late 2022. And after the rate cut on July 31, 2024, the rate steepens. Hmm, hope J Pow makes the soft landing :))

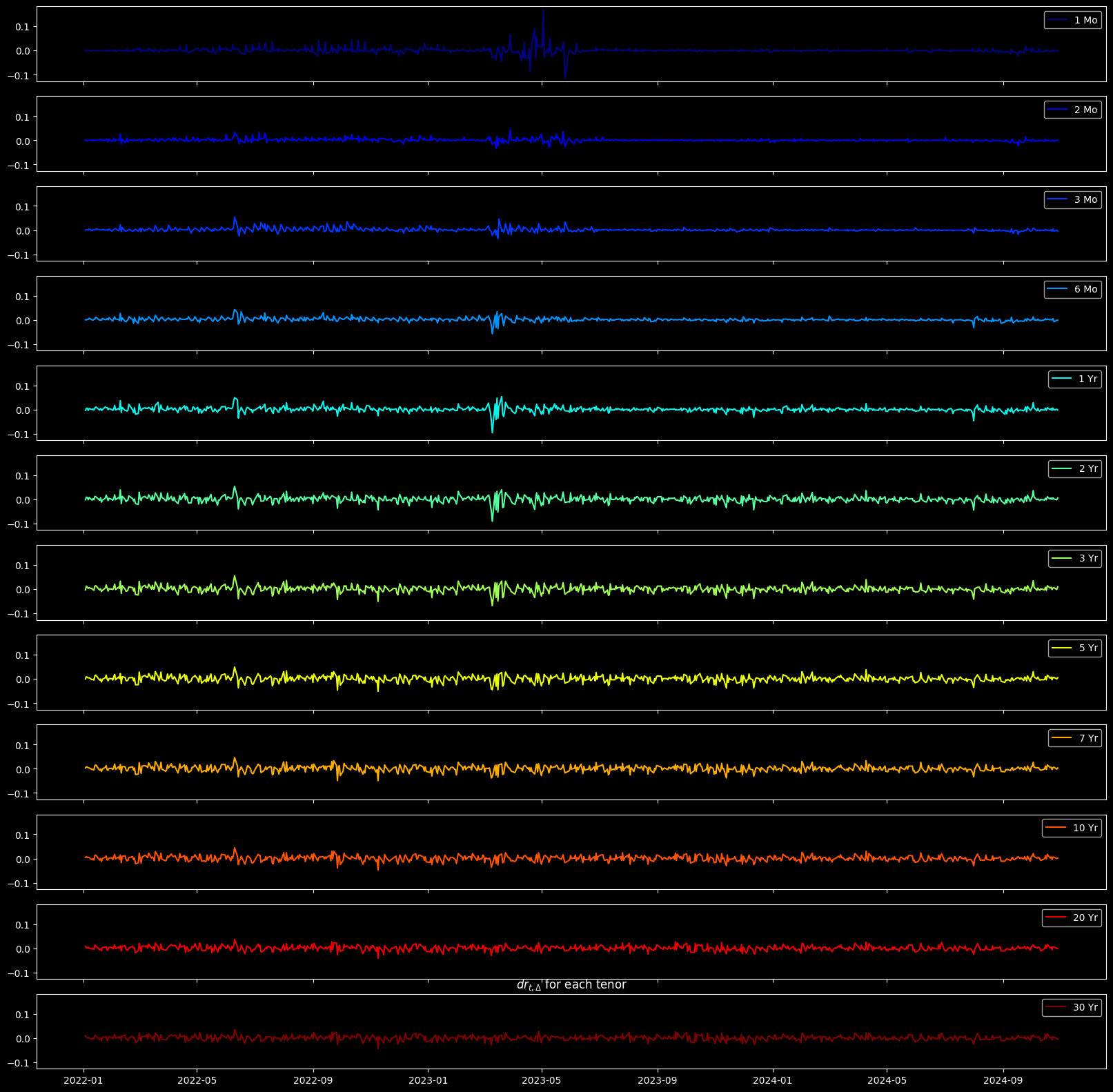

Volatility of yields

Enough econ yapping, back to business. We want to analyze the volatilities so we can cook the term structure using HJM. We calculate the overnight (close to instant) change of spot rate, defined as , to represent the yield volatility Ok, what's next, we want to find a way to express this volatility using linear terms

dftt = pd.DataFrame(np.diff(par_yields, axis=0),

index=par_yields.index[:-1],

columns=par_yields.columns)

# Remove the first date, n rows -> n-1 rows

# dftt[i,j] = ftt[i,j] - ftt[i-1][j]

dftt = dftt * np.sqrt(252) # Anualize df(t,t)

print("Latest 5 dr(t)")

display(dftt.iloc[-5:]) # TOP 5 dftt

colors = plt.cm.jet(np.linspace(0,1,len(tenors_str)))

fig, ax = plt.subplots(len(tenors_str), sharex=True, sharey=True, figsize=(20,20))

for i, tenor in enumerate(tenors_str):

ax[i].plot(dftt.index, dftt[tenor], color=colors[i], label = tenor)

ax[i].legend(loc='best')

plt.title('$dr_{t, \Delta}$ for each tenor')

plt.show()

Latest 5 dr(t)

| 1 Mo | 2 Mo | 3 Mo | 6 Mo | 1 Yr | 2 Yr | 3 Yr | 5 Yr | 7 Yr | 10 Yr | 20 Yr | 30 Yr | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||||

| 2024-10-23 | -0.001587 | -0.003175 | -0.004762 | 0.000000 | -0.003175 | 0.000000 | -0.001587 | -0.003175 | -0.003175 | -0.004762 | -0.006350 | -0.006350 |

| 2024-10-24 | 0.003175 | 0.001587 | 0.004762 | 0.004762 | 0.006350 | 0.006350 | 0.004762 | 0.006350 | 0.004762 | 0.006350 | 0.006350 | 0.006350 |

| 2024-10-25 | -0.001587 | -0.003175 | -0.004762 | -0.007937 | -0.001587 | 0.001587 | 0.006350 | 0.006350 | 0.006350 | 0.004762 | 0.004762 | 0.003175 |

| 2024-10-28 | 0.000000 | 0.000000 | 0.000000 | -0.001587 | 0.001587 | -0.001587 | -0.001587 | 0.000000 | -0.001587 | 0.000000 | 0.000000 | -0.001587 |

| 2024-10-29 | -0.001587 | 0.000000 | -0.004762 | -0.001587 | -0.001587 | 0.006350 | 0.009525 | 0.004762 | 0.003175 | 0.001587 | -0.001587 | -0.004762 |

One more yapping, look at the 1-month T-bill yields, they are mad volatile. We will see the reasoning later in the blog.

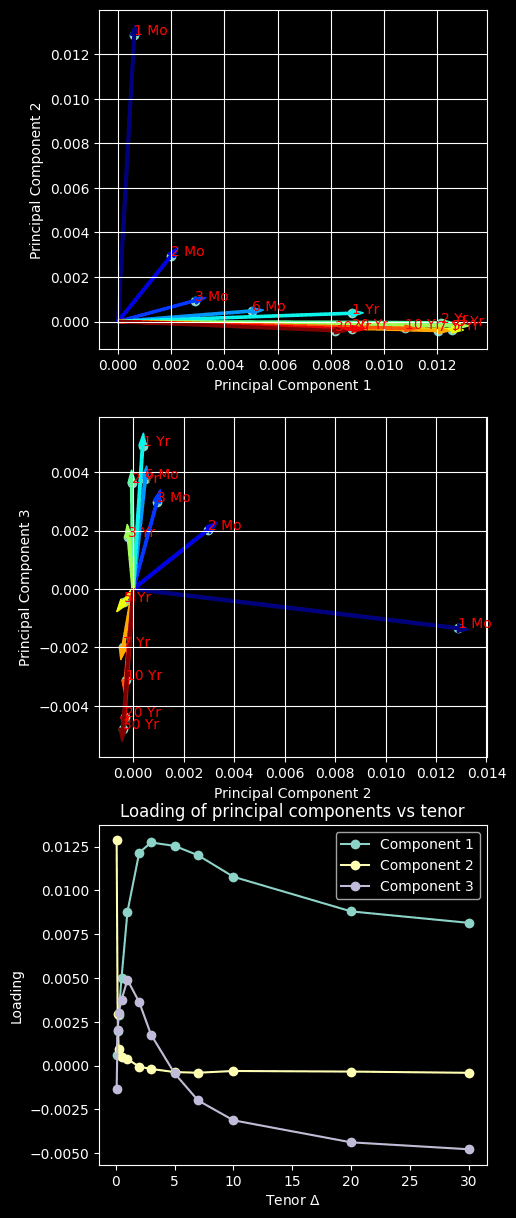

PCA

All factors

To express the 'overall' volatility, which reflects the volatility of the whole term structure, not just the short-term, not just the long-term, but the whole structure. We are going to use PCA to find major components that explain the volatilities.

n_components = len(tenors_str)

pca = PCA(n_components=n_components, svd_solver='full') # Get at least 10 explainable tenors

pca.fit(dftt)

acc_explained_var_ratio = pca.explained_variance_ratio_.cumsum()

fig, ax = plt.subplots(figsize=(8,8))

ax.plot(np.arange(1, n_components+1), acc_explained_var_ratio, marker='o', label='Explainability Ratio')

ax.set_xlabel('Number of Principal Component')

ax.set_ylabel('Explained Variance Ratio')

ax.axhline(0.9, color='red', label='90% Minimum Explainability Ratio Threshold', ls='--')

ax.legend(loc='best')

plt.title('Accumulated explained $\hat{\sigma}^2$ ratio vs number of principal components')

plt.show()

Cool, we got all the components. It appears that first 3 principal components are sufficient as they could explain 90% of the volatilities.

Loadings

But before we examine the first two components, let's quickly revisit loadings

What we did in PCA was decomposing covariance matrix into a scalar part (eigen value) and a vector part (eigen vector). As a weighted version of eigen vector, loadings are regression factors (not necessarily correlations), and indicate how strongly the volatility of a tenor and a principal component are associated

pca = PCA(n_components=3, svd_solver='full') # Get at least 10 explainable tenors

pca.fit(dftt)

loadings = pca.components_.T * np.sqrt(pca.explained_variance_)

print('Loadings: eigen vectors scaled by eigen values')

display(pd.DataFrame(loadings, columns=pca.get_feature_names_out(), index=tenors_str))

fig, ax = plt.subplots(3, 1, figsize=(5,15))

for j in range(2):

pcX, pcY = j, j+1

ax[j].scatter(loadings[:, pcX], loadings[:, pcY])

ax[j].set_xlabel(f'Principal Component {pcX+1}')

ax[j].set_ylabel(f'Principal Component {pcY+1}')

# Add variable labels to the plot

colors = plt.cm.jet(np.linspace(0,1,len(tenors_str)))

for i, tenor in enumerate(tenors_str):

ax[j].annotate(tenor, xy=(loadings[i, pcX], loadings[i, pcY]), color='red')

ax[j].arrow(x=0, y=0, dx=loadings[i, pcX], dy=loadings[i, pcY], color=colors[i], width=1/10000)

ax[j].grid(True)

ax[2].plot(tenors_float, loadings, marker='o', label=[f'Component {i+1}' for i in range(3)])

ax[2].legend(loc='best')

ax[2].set_xlabel('Tenor $\Delta$')

ax[2].set_ylabel('Loading')

ax[2].set_title('Loading of principal components vs tenor')

plt.show()

Loadings: eigen vectors scaled by eigen values

| pca0 | pca1 | pca2 | |

|---|---|---|---|

| 1 Mo | 0.000612 | 0.012857 | -0.001340 |

| 2 Mo | 0.002004 | 0.002959 | 0.002027 |

| 3 Mo | 0.002891 | 0.000939 | 0.002980 |

| 6 Mo | 0.005029 | 0.000474 | 0.003770 |

| 1 Yr | 0.008778 | 0.000372 | 0.004895 |

| 2 Yr | 0.012155 | -0.000057 | 0.003628 |

| 3 Yr | 0.012741 | -0.000188 | 0.001774 |

| 5 Yr | 0.012545 | -0.000367 | -0.000437 |

| 7 Yr | 0.012011 | -0.000404 | -0.001988 |

| 10 Yr | 0.010782 | -0.000305 | -0.003121 |

| 20 Yr | 0.008806 | -0.000339 | -0.004379 |

| 30 Yr | 0.008151 | -0.000410 | -0.004775 |

Note that principal components are now new magical features/variables/factors composed of volatilities of Treasuries in different tenors.

Quick review on Treasuries naming:

T-bills are the short-term (tenor 1 yr) Treasuries

T-notes are the mid-term (1 < tenor < 10 yr) Treasuries

T-bonds are the long-term (10yr < tenor ) Treasuries

Based on the loading plots, we have some interesting insights:

- The 1st principal component primarily explains the volatility of the T-note (mid-term) and the T-bond (long-term) par yield

- The 2nd principal component primarily explains the volatility of the 1-month T-bill (short-term) par yield

- The 3rd principal component explains the negative association between the volatility of the T-bill (short-term) and that of the T-bond (long-term)

This aligns with the reality that, short-term yields are more directly affected by monetary policies than long-term yields. Although short-term and long-term yields usually move in the same direction, but the latter move in a smaller magnitude. This is because long-term yields reflect the market's expectation for economic performance. When the yield curve flattens or steepens, two ends of the curve could move in different directions, or the same direction but in significantly different magnitudes.

In other words, the 1st principal component explains the effect of monetary policy on left-hand side of term rate evolution. The 2nd principal component explains the parallel shift of yield rates caused by the market's confidence in the economy. The 3rd principal component, along with the 1st and 2nd, explains the behavior of steepening and flattening

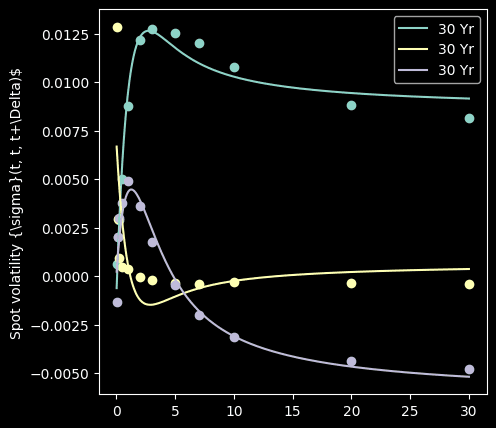

Volatility fitting

Now we want to express each volatility component as a function of tenor .

How do we want to fit the volatility component then? Of course there are many fitting models in our arsenal, incluidng some badass like deep neuron network. But for demonstration purposes, we will use the famous Nelson-Siegel model, which is usually used for yield curve modeling (interestingly not for yield volatility).

def nelson_siegel(tau, b0, b1, b2):

decay = b1 * (1-np.exp(-tau))/tau

hump = b2 * ((1-np.exp(-tau))/tau -np.exp(-tau))

return b0 + decay + hump

class Volatility:

def __init__(self, fit_fn):

self.fit_fn = fit_fn

self.fit_params = []

def fit(self, loading, tenors_float):

self.fit_params = []

for i, loading in enumerate(loadings.T):

popt, _ = curve_fit(self.fit_fn, tenors_float, loading, method='lm')

self.fit_params.append(popt)

def predict(self, tenors):

return np.array([nelson_siegel(tenors, *popt) for popt in self.fit_params])

fig, ax = plt.subplots(figsize=(5,5))

vola = Volatility(nelson_siegel)

vola.fit(loadings, tenors_float)

tenors_sim = np.linspace(0, 30, 1000)

vola_curves = vola.predict(tenors_sim)

for i, component in enumerate(loadings.T):

ax.plot(tenors_sim, vola_curves[i], label=tenor)

ax.scatter(tenors_float, component)

ax.set_label('Tenor $\Delta$')

ax.set_ylabel('Spot volatility {\sigma}(t, t, t+\Delta)$')

ax.legend(loc='best')

ax.plot()

[]

It fits quite well.

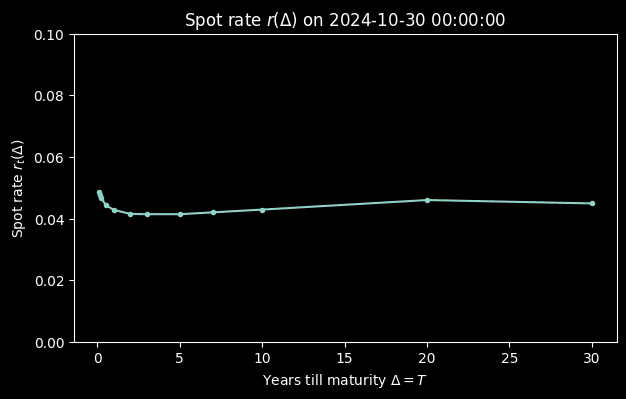

After analyzing the past rates, finally, let's project future rates! But before that, we need present rates, the spot rate

# Spot

spot_yield = par_yields.iloc[-1,:] # Latest fwd rate

fig, ax = plt.subplots(figsize=(7,4))

ax.plot(tenors_float, spot_yield, marker='.')

ax.set_ylim(0, 0.1)

ax.set_xlabel(f'Years till maturity $\Delta = T$')

ax.set_ylabel(f'Spot rate $r_t(\Delta)$')

ax.set_title(f'Spot rate $r(\Delta)$ on {par_yields.index[-1]}')

plt.show()

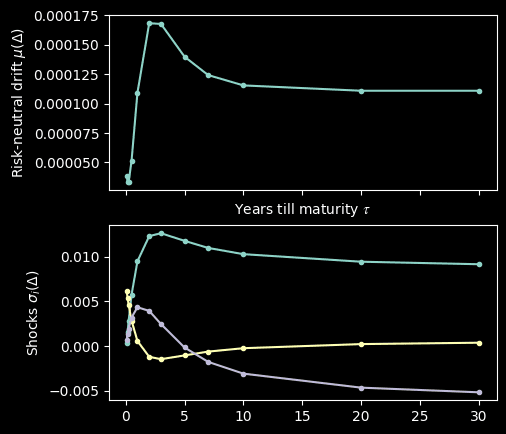

Then we simulate the drift term for a range of

def shock_fn(tau):

#return n * m matrix where n = num principal components and m = len(tau)

return vola.predict(tau)

def drift_fn(tau):

shocks = shock_fn(tau)

# If tau a list-like

return (shocks * shocks).sum(axis=0)

foward_tenor = np.linspace(0, 5, 1000)

spot_drift = drift_fn(tenors_float)

fig, ax = plt.subplots(2,1, figsize=(5, 5), sharex=True)

ax[0].plot(tenors_float, spot_drift, marker='.')

ax[0].set_xlabel(f'Years till maturity $ 𝜏$')

ax[0].set_ylabel(f'Risk-neutral drift $\mu(\Delta) $')

ax[0].xaxis.tick_bottom()

ax[1].plot(tenors_float, shock_fn(tenors_float).T, marker='.')

ax[1].set_ylabel(f'Shocks $\sigma_i(\Delta) $')

plt.show()

We simulate by

Simulate Forward Rate

import numpy as np

from concurrent.futures import ProcessPoolExecutor, as_completed

import os

class ForwardRateSimulator:

def __init__(self, vola, drift_fn, shock_fn, spot, fwd_tenor, fwd_period, step=1/365):

# Range of tenors in years. This is tau's in f(t,T,T+tau)

self.fwd_tenors_str = fwd_tenor if isinstance(fwd_tenor[0], str) else tenor_float_to_str(fwd_tenor)

self.fwd_tenors_float = fwd_tenor if not isinstance(fwd_tenor[0], str) else tenor_str_to_float (fwd_tenor)

self.fwd_period = fwd_period # Time to lock-in date in years. This is T in f(t,T,T+tau)

self.step = step # Increment steps

self.spot = spot # Initial value f(0,0,tau) for all tau in fwd_tenors

self.vola = vola

self.drift_fn = drift_fn

self.shock_fn = shock_fn

def simulateOne(self):

nSteps = int(self.fwd_period / self.step) # Total number of steps

# n by m matrix

# where n = number of timepoints in the future

# m = number of desired forward tenors

np.random.seed((os.getpid() * int(time.time()))%100000)

paths = np.zeros((nSteps, len(self.fwd_tenors_float)))

paths[0] = self.spot[self.fwd_tenors_str]

T = self.fwd_period

dT = np.diff(tenor_str_to_float(list(self.spot.index)))

dt = self.step

# Simulate f(t,T,T+tau) for all t up to T

for t in range(1,len(paths)):

prev_f = paths[t-1]

drift = drift_fn(self.fwd_tenors_float)

shocks = shock_fn(self.fwd_tenors_float)

curr_f = prev_f + drift * dt \

+ (shocks * norm.rvs(size=(shocks.shape)) * np.sqrt(dt)).sum(axis=0)

paths[t] = curr_f

return pd.DataFrame(paths, columns=self.fwd_tenors_str)

def simulateN(self, nTrials, nProc=os.cpu_count()-1):

results = []

# Set up a process pool to distribute the simulation

with ProcessPoolExecutor(max_workers=os.cpu_count() - 1) as ex:

futures = [ex.submit(self.simulateOne) for _ in range(nTrials)]

for i, fut in enumerate(as_completed(futures)):

results.append(fut.result())

return np.array(results)

sim_tenors = ['1 Mo', '1 Yr', '5 Yr', '7 Yr', '10 Yr']

steps = 1/365 # Year -> day

fut_horizon = 3 #Years

nTrial = 10000

simulator = ForwardRateSimulator(vola, drift_fn, shock_fn, spot_yield, sim_tenors, fut_horizon, steps)

res = simulator.simulateN(nTrial)

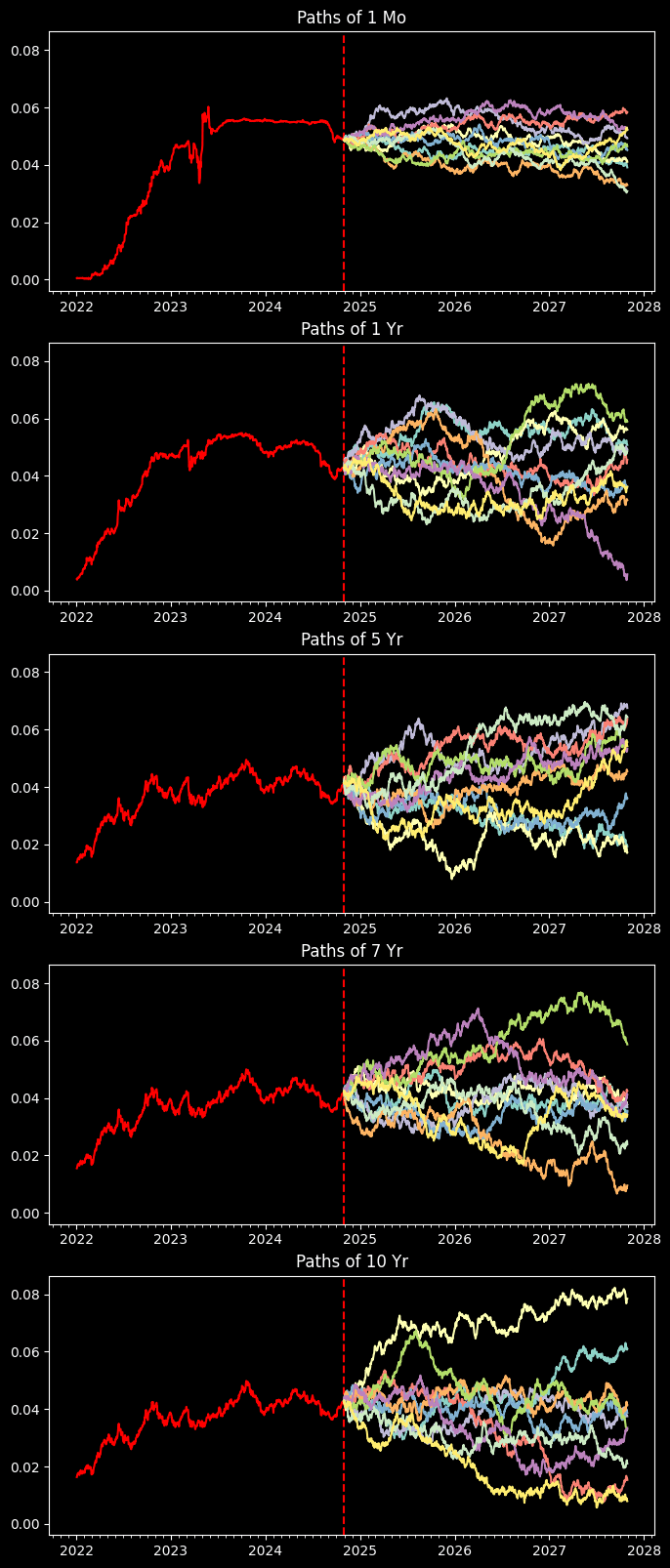

Done with simulations, now let's plot out the sample paths for different treasuries

fig, ax = plt.subplots(len(sim_tenors), 1, figsize=(8,4 * len(sim_tenors)), sharey=True)

present = np.datetime64(par_yields.index[-1], 'D')

future_timeline = present + np.array([i for i in range(int(fut_horizon/steps))])

for i, tenor in enumerate(sim_tenors):

ax[i].xaxis.set_major_locator(mdates.MonthLocator(bymonth=(1)))

ax[i].xaxis.set_minor_locator(mdates.MonthLocator())

ax[i].plot(par_yields.index, par_yields[tenor], color='red')

ax[i].axvline(par_yields.index[-1], color='red', ls='--')

ax[i].set_title(f"Paths of {tenor}")

# Display up to 10 path

for sim_i, sim in enumerate(res):

if sim_i < 10:

ax[i].plot(future_timeline, sim.T[i])

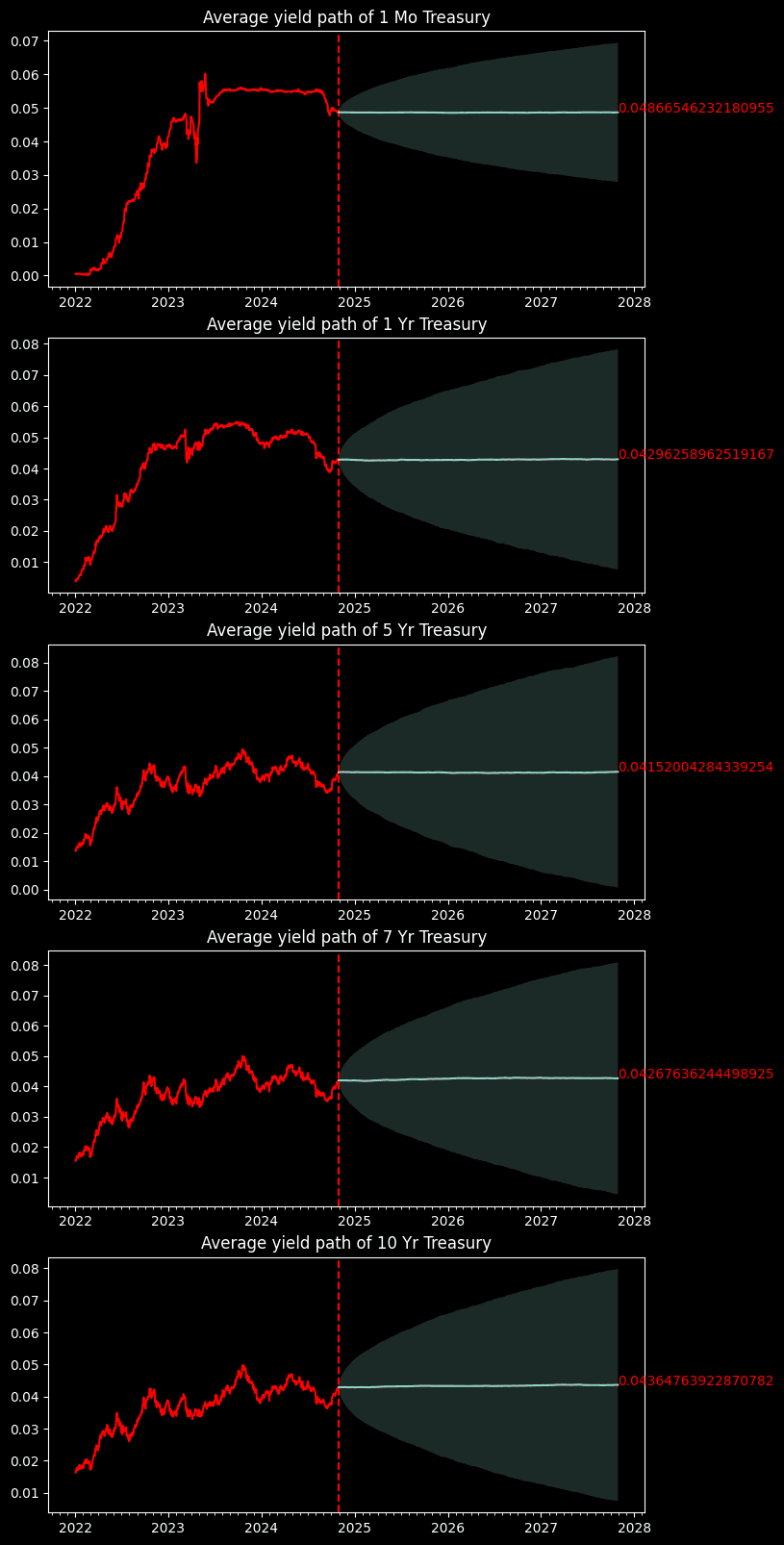

We take the average of the path

fig, ax = plt.subplots(len(sim_tenors), 1, figsize=(8,4 * len(sim_tenors)))

for i, tenor in enumerate(sim_tenors):

path_mean = res.mean(axis=0).T[i]

path_CI = 1.96 * res.std(axis=0).T[i]

ax[i].xaxis.set_major_locator(mdates.MonthLocator(bymonth=(1)))

ax[i].xaxis.set_minor_locator(mdates.MonthLocator())

ax[i].plot(par_yields.index, par_yields[tenor], color='red')

ax[i].axvline(par_yields.index[-1], color='red', ls='--')

ax[i].set_title(f"Average yield path of {tenor} Treasury")

# Display up to 10 path

ax[i].plot(future_timeline, path_mean)

ax[i].fill_between(future_timeline, path_mean - path_CI, path_mean + path_CI, alpha=0.2)

ax[i].annotate(path_mean[-1], xy=(future_timeline[-1], path_mean[-1]), color='red')

And here we go, we got several projected US Treasury yields over the next 3 years. It's trivial to say that average projected rates are nearly the same as the spot rate. This is because we have a risk-neutral drift that is nearly 0. Otherwise the treasury yields will go to infinity as time grows. Nevertheless, we can use the simulations backed by HJM to profile the market risk.

What's next?

In this blog, we focus on the spot rate for different . What would the term evolution look like if we are simulating ? Spoil alert, it will go upward as it has a positive risk-neutral drift. We will show that in the future blogs. We will "cook" the UK forward yield curve :))